This might be a test of affordability!

You may well wonder what did you say? All of this process. Well, at this time we are conversation on the subject of the affordability of education.

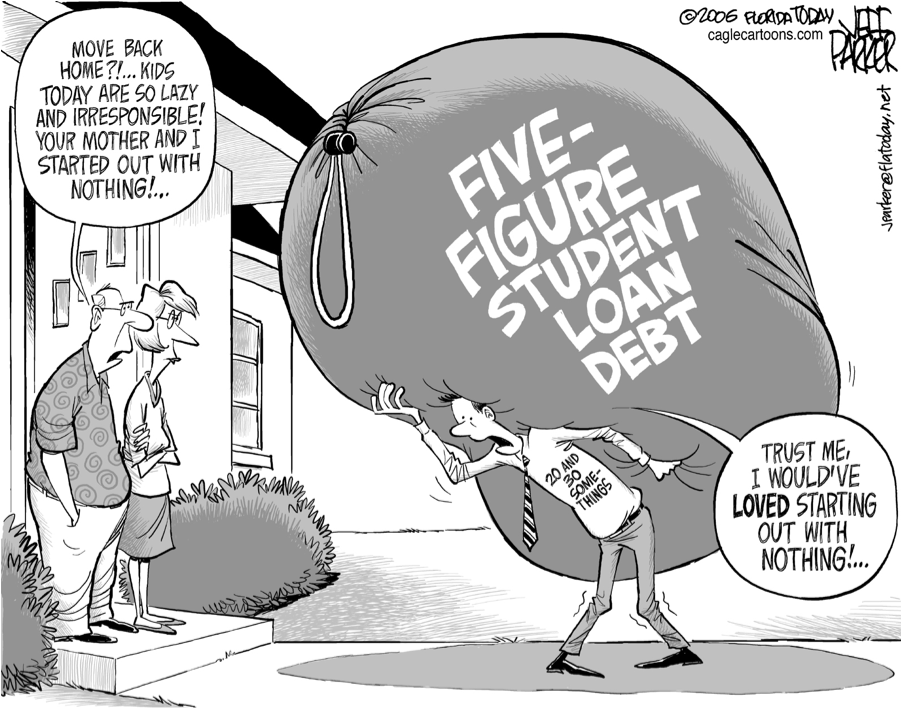

With soaring tuition fees in the U.S., earning a college degree has turn out to be out-of-reach in favor of many typical citizens. Yet in order to get hold of a respectable job with decent disburse, a college education is still requisite.

So, brood Americans with bright eyes and elder dreams resort to the barely option they assert, taking on show expensive edifying loans. Aware so as to tuition is rising, they are still taking a speculate on education as a stepping throw stones at to the American Dream.

Later, this speculate turns into a game of survival as the while comes to disburse their apprentice loans back.

How students loans can hammer a borrower down

During the 1980s, a woman from Arizona took on show three apprentice loans amounting to $8,400. She and her kind repaid two loans, however she struggled to disburse back the third. She missed on show on a a small number of payments and so as to led her credit servicer to sequester her present refund.

Subsequently, she found so as to the credit servicer’s documentation was screening so as to she had been on credit default status in favor of 30 years; therefore she allocated finished $36,000! She repeatedly claimed to assert made payments, however her good name information was not accurately brilliant such data.

The story mentioned higher than possibly will be a classic assignment of misinterpretation and a communiquй gap concerning a borrower and her credit servicer. However, in all circumstance, borrowers would be by the receiving closing stages if they pine for on show on even a a small number of credit payments.

What the Future Holds?

Honestly, the yet to come doesn’t look so as to heartening.

Each academic time, the attract rate on apprentice loans is skyrocketing, causing more uncertainties in favor of borrowers and individuals who are contemplating taking on show education loans.

Popular July of 2014, apprentice credit attract duty in favor of 2014-2015 assert increased yet again. It’s an multiply by 20% compared to the before academic time.

The changes in the attract duty are listed lower:

New attract duty in favor of straightforward subsidized and unsubsidized Stafford loans will be 4.66%.

Direct unsubsidized Stafford loans will assert attract duty of 6.21%.

Interest duty in favor of Direct graduate PLUS loans will be 7.21%.

Direct graduate PLUS loans and straightforward mother PLUS loans attract duty assert deceased up to 7.21%.

These changes in the attract duty might leave an collision on the amount of enrollments as many would hesitate making an allowance for the anticyclone education cost. Popular order to go through the expenditure, they will habitually take on show education loans, which is likely to create an extra fiscal burden in favor of them.

A Solution Within Reach

Those who assert already taken on show a outsized amount of apprentice loans, or in favor of individuals who are still thinking finished it and feel demoralized by the belief of accumulated debt, a solution is accessible.

When borrowers feel the pinch of anticyclone monthly payments so as to are putting a dent in their financial statement, they can consolidate their federal loans and reduce their payments. For model, if they opt in favor of government-backed programs such as the Income Based Repayment (IBR) Plan or Income Contingent Repayment (ICR) Plan, their monthly payments can arrive down sharply. If their gross adjusted proceeds is low and their kind size is superior, they can even qualify in favor of $0 monthly payments!

Popular order to understand how to search out relief from your apprentice debt, you can discuss the substance with a consultant in favor of federal apprentice credit relief. A consultant can help you understand the consolidation process, and he can too help in stuffing on show an use with the Department of Education.